Planned Giving – Leaving a Legacy for Family and Cancer Care

May 1, 2024

Found in BC Cancer - Kelowna, Leave a Legacy

Article was originally published on Castanet on May 1, 2024.

As a 36-year-old busy, seemingly healthy lawyer and mom to two young boys, Kelowna’s Anjali Coyle never expected a shower after yoga would change her life forever. But that’s exactly what happened in September 2019 when she found a lump while bathing. Further testing uncovered Stage 3 breast cancer.

Anjali’s sharing her story to bring awareness to two passions close to her heart: cancer care and estate planning.

After her diagnosis, leaving a legacy gift to the BC Cancer Foundation was an easy decision. It was a way to give thanks to her care team and to take advantage of the tax incentives of leaving a charitable gift.

“Many people don’t know including charities in their will is an option, so they’re missing out on giving to a cause they care about and potential tax break benefits,” says Anjali, who is well-versed in the topic as the founder and CEO of EstateBox – a virtual platform to help simplify estate planning.

Estates are taxed in Canada, but including charitable gifts in your estate plans can generate a tax credit, decreasing the amount your estate pays in taxes and increasing its net value.

Wanting to ensure her children are taken care of, Anjali set a threshold in her will. If her estate doesn’t reach a set size, it will be divided between her children. If it does reach this limit, the extra assets will be directed to the BC Cancer Foundation and other charities she holds close.

“I can’t predict the future, but I hope to have a long and successful life. I thought about what my kids need. What kind of life do I want for them? What’s going to teach them the right values? With any excess, what was I going to do with that?”

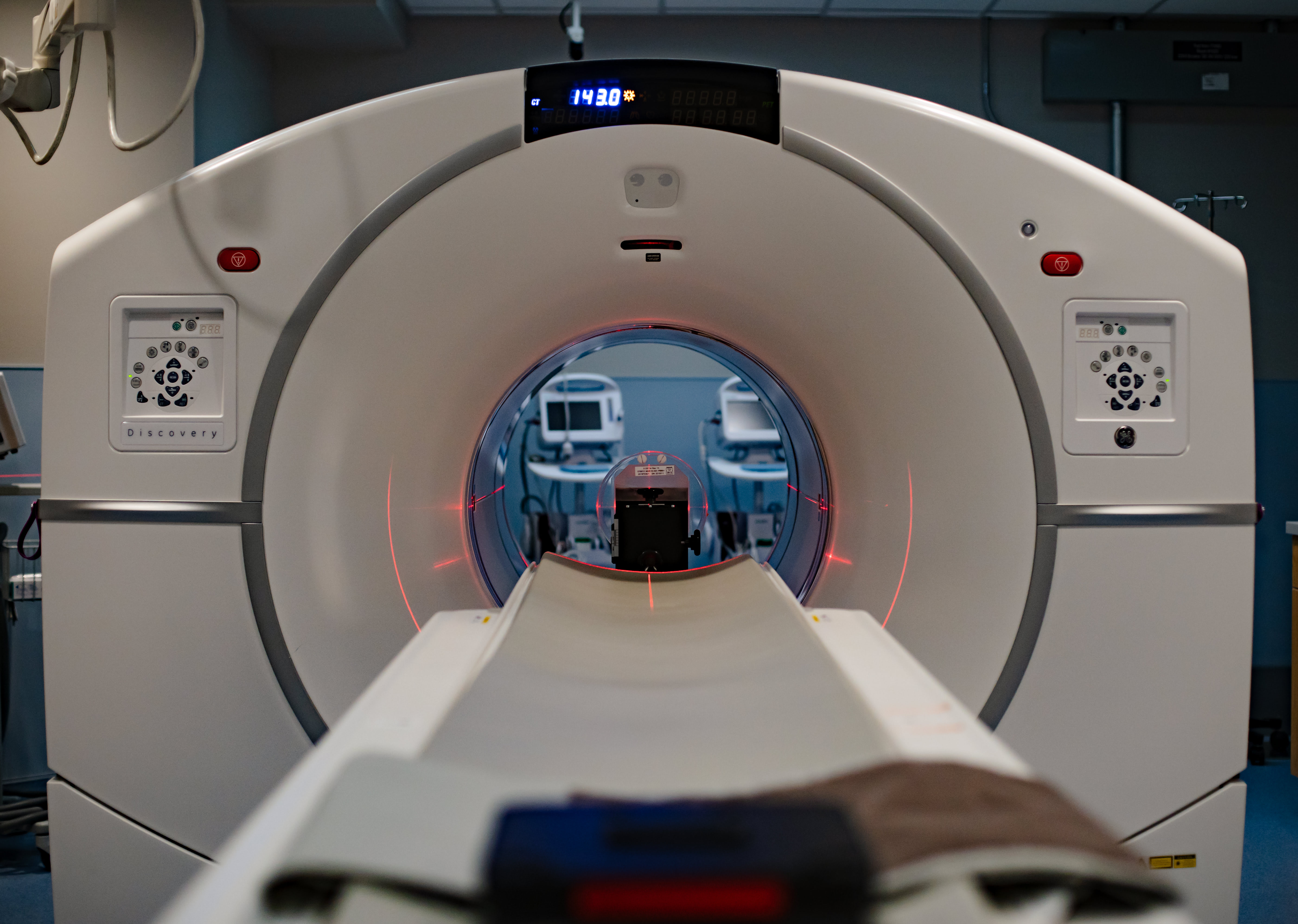

Anjali’s treatment included surgeries, chemotherapy and radiation. It was an incredibly difficult time physically and emotionally. She was forced to take time off work and even consider the unimaginable possibility that she wouldn’t be there to watch her kids grow up.

Thanks to the care she received at BC Cancer – Kelowna, Anjali is now planning for a future where she can leave two important legacies in the world. She’ll leave her children, who she’s raising to become well-rounded, financially independent adults. And she’ll leave a gift to BC Cancer to support the future of cancer research and care that will benefit her children’s generation and beyond.

Remembering the BC Cancer Foundation in your estate plans supports innovative research, treatments and care that will improve – and save – the lives of families throughout British Columbia for generations to come.

To learn more about leaving a legacy gift to the BC Cancer Foundation, we welcome you or your advisor to contact Jordan McClymont at 250.415.1888 or jordan.mcclymont@bccancer.bc.ca.

Or visit, bccancerfoundation.com/LegacyGiving